Welcome to our comprehensive guide on BigCharts, the ultimate charting platform for achieving stock market success. Whether you’re a seasoned investor or just starting your journey, BigCharts offers a wealth of features and tools to help you make informed decisions and navigate the complexities of the financial market.

Charting plays a crucial role in understanding market trends, identifying potential investment opportunities, and managing risk effectively. With BigCharts, you can analyze historical stock data, interpret market trends through advanced tools, and customize your analysis to suit your unique trading strategy.

In this guide, we will take you through the ins and outs of using BigCharts, exploring its key features, and showcasing how it can empower you to make better investment decisions. From navigating the platform to accessing historical stock prices and interpreting market trends, we will leave no stone unturned.

So whether you’re a beginner looking to understand the basics or an experienced trader seeking advanced techniques, this comprehensive guide will provide you with the knowledge and tools needed to harness the power of BigCharts and achieve stock market success.

Key Takeaways:

- BigCharts is a powerful charting platform for achieving success in the stock market.

- Understanding the features and tools of BigCharts is essential for making informed investment decisions.

- By accessing historical stock prices and interpreting market trends, you can enhance your trading strategy.

- Customizing your analysis with BigCharts’ interactive charts allows you to personalize your trading approach.

- Integration with MarketWatch enhances your trading strategy and provides additional insights.

Understanding BigCharts and Its Impact on the Financial Industry

BigCharts, a popular charting platform in the financial industry, has made a significant impact on how investors analyze and interpret market data. In order to fully comprehend the capabilities and benefits of BigCharts, it is important to understand its history and evolution.

What is BigCharts?

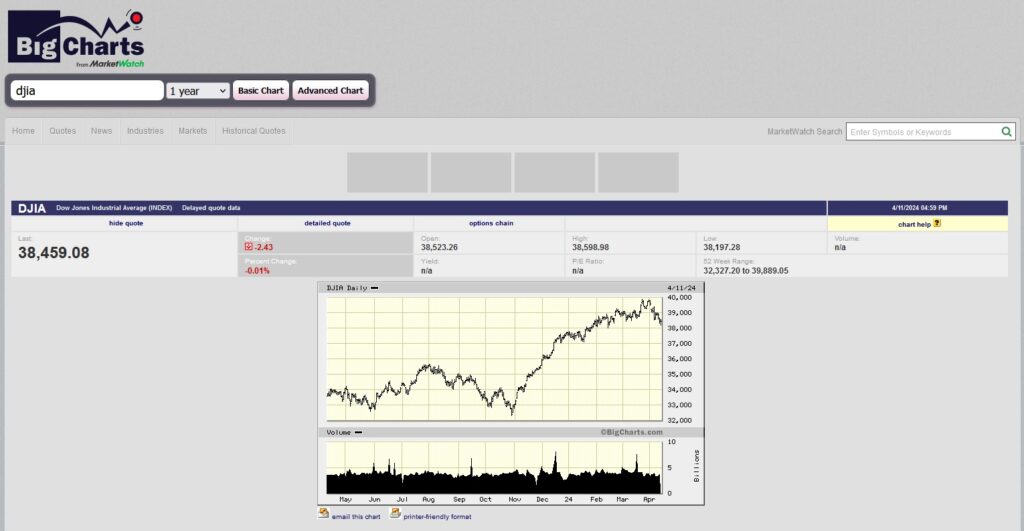

BigCharts is a comprehensive charting platform that provides investors with access to real-time and historical market data. It offers a wide range of technical indicators, advanced charting tools, and customizable features to assist investors in making informed investment decisions. By leveraging BigCharts, investors can gain valuable insights into market trends and patterns.

The Evolution of Charting Platforms

Over time, charting platforms have undergone significant advancements in terms of functionality, accessibility, and user experience. BigCharts has played a prominent role in this evolution by offering innovative solutions to meet the changing needs of investors. Its user-friendly interface, robust features, and accurate data have made it a preferred choice among traders and analysts.

Why Investors Rely on BigCharts

The financial industry relies on charting platforms like BigCharts for several reasons. Firstly, BigCharts provides easy-to-use tools that allow investors to analyze market data in a visually appealing and intuitive manner. Secondly, it offers real-time data updates, ensuring that investors have access to the most current information. Finally, BigCharts’ reputation for accuracy and reliability has earned the trust of investors, making it a go-to resource for charting and analysis.

In conclusion, understanding the history and impact of BigCharts is crucial for investors looking to utilize its full potential. By providing a comprehensive and user-friendly platform, BigCharts has revolutionized the way investors analyze market data, making it an invaluable tool in the financial industry.

Navigating BigCharts: Key Features Explained

When it comes to using BigCharts effectively, understanding its key features is essential. Navigating the platform and making the most of its functionalities can greatly enhance your stock market analysis and decision-making process.

One of the key features of BigCharts is its user-friendly interface, which allows for seamless navigation. Upon accessing the platform, you will be greeted with an intuitive design that enables easy exploration of various charting options.

To begin, you can select your desired stock symbol and choose the timeframe for your analysis. BigCharts offers a wide range of chart types, including line charts, candlestick charts, and bar charts, each with its own unique benefits and insights.

Once you have selected your preferred chart type, you can utilize BigCharts’ zooming and scrolling capabilities. This allows for a more detailed analysis of historical stock data, helping you identify patterns and trends that can influence your investment decisions.

Furthermore, BigCharts provides a plethora of technical indicators that can be applied to your charts. These indicators, such as moving averages and trendlines, help you analyze price movements and identify potential entry or exit points for your trades.

In addition to technical indicators, BigCharts also allows for the inclusion of overlays, such as Bollinger Bands and volume indicators. These overlays provide supplementary information and insights, adding depth to your chart analysis.

Throughout your navigation of BigCharts, you can easily save and customize your charts for future reference. This allows you to track the performance and trends of specific stocks over time, enabling more informed investment decisions.

Overall, understanding and efficiently navigating BigCharts’ key features is crucial to harnessing its full potential. By utilizing the various functionalities offered by BigCharts, you can enhance your stock market analysis and increase your chances of achieving success in your investments.

Utilizing Historical Stock Prices for Informed Investment Decisions

Accessing historical data plays a crucial role in making informed investment decisions. When it comes to analyzing stock price history, BigCharts provides an invaluable resource for investors. By accessing historical stock prices on BigCharts, investors can gain valuable insights and make more confident investment decisions.

Accessing Historical Data

BigCharts offers a seamless and user-friendly interface to access historical stock prices. With just a few clicks, users can easily find and retrieve historical data for any stock. This wealth of historical information allows investors to analyze trends, identify patterns, and make informed predictions about future stock performance.

How to Analyze Historical Stock Prices

When analyzing historical stock prices on BigCharts, there are several key factors to consider. The first step is to examine the overall trend of the stock over a specific time period. This can be done by plotting the stock’s historical prices on a line chart, which visually depicts the stock’s movement over time.

Next, investors can utilize technical indicators such as moving averages and trendlines to identify potential entry and exit points. These indicators help to smooth out price fluctuations and highlight important price levels that may indicate market trends.

Furthermore, investors can analyze historical stock prices by looking for patterns such as support and resistance levels, chart patterns, and volume trends. By studying these patterns, investors can gain insights into market sentiment and make more accurate predictions about future stock movements.

The Benefits of Studying Stock Price History

Studying stock price history on BigCharts offers numerous benefits for investors. Firstly, it provides a historical context and perspective, allowing investors to understand how a stock has performed in different market conditions. This knowledge can help investors identify potential risks and opportunities, as well as gain insights into the stock’s volatility and stability.

Secondly, studying stock price history helps investors develop a disciplined and systematic approach to investment. By analyzing historical data, investors can identify their own investment strategies, risk tolerance, and preferred holding periods. This level of self-awareness enables investors to make more informed decisions and stick to their long-term investment plans.

Lastly, studying stock price history on BigCharts allows investors to learn from the successes and failures of past investments. By analyzing historical data, investors can evaluate the effectiveness of their trading strategies and refine their approach over time. This continuous improvement process is essential for long-term success in the stock market.

BigCharts: Interpreting Market Trends through Advanced Tools

When it comes to navigating the complex world of stock market trends, having access to advanced tools that can help interpret these trends is crucial for investors. BigCharts, a leading charting platform, offers a suite of advanced tools designed to assist users in analyzing and understanding market trends effectively.

One of the key features of BigCharts is the ability to plot trendlines directly on the charts. Trendlines help investors identify the direction and strength of a particular trend, whether it’s an upward or downward movement. By analyzing these trendlines, users can gain valuable insights into potential market patterns and adjust their investment strategies accordingly.

Moving averages, another powerful tool offered by BigCharts, enable investors to smooth out short-term fluctuations and identify long-term trends more effectively. By calculating the average price of a security over a specific period, moving averages provide a clearer picture of the overall market sentiment. This information can be invaluable for investors looking to make informed decisions based on historical price data.

BigCharts also provides a range of other technical indicators that can be used to interpret market trends comprehensively. These indicators include volume analysis, Bollinger Bands, relative strength index (RSI), and many more. By utilizing these advanced tools, investors can gain a deeper understanding of market dynamics and potentially capitalize on profitable trading opportunities.

Whether you are a seasoned investor or just starting your stock market journey, BigCharts’ advanced tools can empower you to make more informed decisions based on market trends. By utilizing the features and functionality offered by BigCharts, you can gain a competitive edge and enhance your ability to interpret market trends with confidence.

Customizing Your Analysis with BigCharts’ Interactive Charts

Personalizing Chart Settings

One of the key advantages of using BigCharts for your stock market analysis is the ability to personalize chart settings according to your preferences. With BigCharts’ interactive charts, you can customize various aspects of your charts to suit your specific needs.

From choosing the time frame to selecting the type of chart (such as line, bar, or candlestick), you have the flexibility to tailor the appearance of your charts. This customization allows you to focus on the data that is most relevant to your analysis and enhances your understanding of market trends.

Technical Indicators and Overlays

BigCharts provides a wide range of technical indicators and overlays that can be applied to your charts. These tools enable you to gain deeper insights into market trends and price movements, enhancing the accuracy of your analysis.

Whether you are interested in tracking moving averages, stochastic oscillators, or Bollinger Bands, BigCharts offers a comprehensive selection of technical indicators to choose from. By incorporating these indicators into your analysis, you can identify potential buying and selling opportunities with greater precision.

Identifying Buying and Selling Opportunities with Custom Charts

In addition to personalizing chart settings and using technical indicators, BigCharts also allows you to create custom charts tailored to your specific trading strategies. With custom charts, you can combine different indicators, overlays, and parameters to develop unique chart configurations that align with your investment goals.

By customizing your charts, you can easily identify buying opportunities such as support and resistance levels, trend reversals, or breakout patterns. Similarly, you can spot selling opportunities based on overbought or oversold conditions, divergences, or other technical signals. These customized charts empower you to make more informed trading decisions and maximize your potential for success in the stock market.

Enhancing Your Trading Strategy with BigCharts’ MarketWatch Integration

Integrating BigCharts with MarketWatch can significantly enhance your trading strategy, providing you with valuable insights and information for more informed decision-making. By combining the powerful charting capabilities of BigCharts with the comprehensive market analysis offered by MarketWatch, you can stay ahead of market trends and uncover potential trading opportunities.

With BigCharts’ MarketWatch integration, you can access real-time market data, news, and analysis directly from the platform. This integration allows you to seamlessly switch between charting and market research, saving you time and effort in gathering crucial information for your trading strategy.

MarketWatch integration provides you with access to a wide range of features and tools that can enhance your trading strategy. From market news alerts and economic indicators to expert analysis and stock screeners, you’ll have everything you need to make well-informed trading decisions.

By utilizing BigCharts’ customizable charts and combining them with the market insights from MarketWatch, you can analyze price patterns and trends more effectively. This integration enables you to identify key support and resistance levels, spot potential breakouts or reversals, and determine optimal entry and exit points for your trades.

Furthermore, BigCharts’ MarketWatch integration allows you to create watchlists and track your favorite stocks, keeping you updated on the latest developments and market movements. You can also set up alerts and notifications based on specific criteria, ensuring that you never miss important trading opportunities.

Whether you are a seasoned trader or just starting out, leveraging the power of BigCharts’ MarketWatch integration can provide you with a competitive edge in the financial markets. Stay informed, make smarter trading decisions, and maximize your profit potential with this powerful combination of charting and market analysis.

Comparing BigCharts to Other Charting Platforms: In-Depth Review

Ease of Use and Accessibility

When it comes to ease of use and accessibility, BigCharts stands out among its competitors. The platform offers a user-friendly interface that allows both novice and experienced investors to easily navigate and utilize its charting features. With its intuitive design and straightforward layout, BigCharts ensures a smooth and efficient charting experience for all users.

Furthermore, BigCharts excels in providing accessibility to its users. The platform can be accessed from any device with an internet connection, making it convenient for investors to analyze stock market trends and make informed decisions on-the-go. Whether you’re using a desktop computer, laptop, or mobile device, BigCharts ensures that you can chart your way to success anytime, anywhere.

Comparative Analysis of Charting Features

When comparing BigCharts to other charting platforms, it becomes evident that it offers a comprehensive range of powerful charting features. From customizable technical indicators to interactive charting tools, BigCharts provides investors with a robust toolkit to analyze market trends and identify potential trading opportunities.

Additionally, BigCharts offers a wide variety of chart types, including line charts, bar charts, and candlestick charts, among others. This versatility allows users to analyze stock prices using the charting style that best suits their trading strategies and preferences. With its extensive array of charting features, BigCharts ensures that investors have everything they need to conduct thorough analysis and make informed investment decisions.

User Feedback and Community Trust

Another aspect that sets BigCharts apart is the valuable user feedback and strong community trust it has garnered over the years. Many investors rely on BigCharts for their charting needs due to the positive experiences shared by a wide network of users.

With a dedicated user community that actively provides feedback, BigCharts continuously improves and updates its platform to meet the evolving needs of investors. This strong community trust is a testament to the reliability and effectiveness of the BigCharts platform.

Moreover, the platform’s commitment to accuracy and integrity has fostered trust among the investment community. Investors can rely on BigCharts to provide accurate and up-to-date market data, enabling them to make well-informed decisions based on reliable information.

When it comes to comparing charting platforms, BigCharts emerges as a clear leader. Its ease of use, accessibility, comprehensive charting features, positive user feedback, and community trust make it an ideal choice for investors looking to chart their way to stock market success.

Conclusion

Throughout this comprehensive guide, we have explored the power and functionality of BigCharts in achieving stock market success. By understanding the impact of BigCharts on the financial industry, navigating its key features, and utilizing historical stock prices for informed investment decisions, investors can gain a competitive edge.

With BigCharts’ advanced tools for interpreting market trends and the ability to customize analysis through interactive charts, investors have the opportunity to make well-informed trading decisions and identify buying and selling opportunities.

Furthermore, the integration of BigCharts with MarketWatch enhances trading strategies, providing a holistic approach to market analysis. The in-depth comparison of BigCharts to other charting platforms showcased its unique advantages, ease of use, and the trust it has garnered within the community.

In conclusion, BigCharts is an invaluable tool for investors who strive for success in the stock market. By leveraging its comprehensive features and resources, investors can make informed decisions, analyze market trends, and customize their analysis to suit their individual strategies. Embrace BigCharts today and unlock the potential for your stock market success.