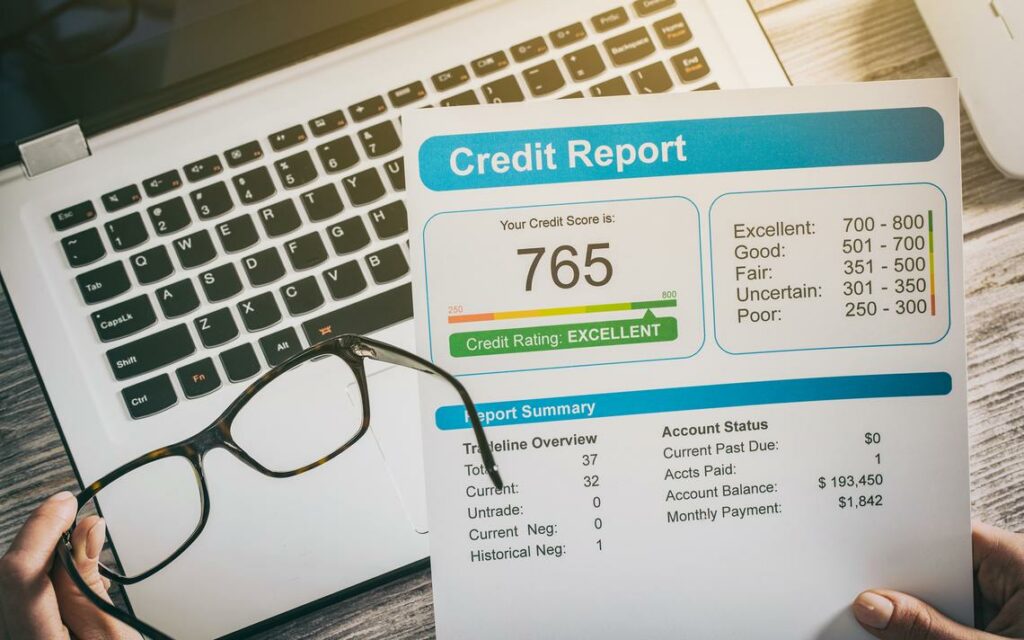

Maintaining a good credit score is invaluable to your financial life. Your credit score is what your creditors use to determine the interest rates and your credit limit. The most popular credit scores used by lenders are FICO® and VantageScore.

Both FICO® and VantageScore operate on a scale of 300 to 850. The baseline for a good score begins at 750. Scores equal and above 800 are considered top-notch.

Not only lenders at banks & credit unions, but also landlords, employers, and insurance companies review your credit information. If you have a low score, your landlord may not rent you the apartment, your employer may pass you over for a promotion, and your insurance company may not insure you or charge you higher-than-average premiums.

Conversely, a good credit score helps secure the best mortgage rates, lower interest rates, and higher credit limits. Your loan applications will be more readily approved, and you’ll be able to lease your dream apartment!

If you foster in yourself few habits noticed in people with scores equal and greater than 800, you’ll gain access to all the perks that come with having a good credit score.

1. Always Pay On Time

The most significant factor comprising your score is your payment history. If you have a history of meeting your obligations late, that tells your creditors that you are comparatively riskier to lend to. Unsurprisingly, people with good credit never miss the deadline on paying their dues.

To ensure that you pay on time, consider setting up automatic payments from your bank account or credit card. Alternatively, you could set up reminders on your smartphone or mark them down on your paper calendar. You could also consider setting up all your due dates around the same date. That way you can pay for everything at once and reduce the risk of missing a payment.

If you ever miss the deadline on a payment, most creditors will extend a grace period the first time; take care of it as soon as possible before they report it to the credit bureaus.

2. Maintain a low credit utilization ratio

Credit Utilization Ratio (CUR) is the total of how much you owe on all your credit cards against the total credit limit of all cards combined. According to Experian, it can impact up to 30% of your credit score. A low CUR shows that you’re using less of your available credit. It signals that you manage your credit responsibly, whereas a high CUR indicates that you are financially overextending.

For lower utilization, experts recommend against exceeding 30% of your total credit limit. Those in the 800-850 range use less than 10% of their entire available credit. To ensure you spend within your means, consider checking if your issuer offers the option of sending email or text notifications upon your crossing a certain threshold.

Paying your credit card debt multiple times per month can also help to keep credit utilization low. Additionally, you could ask your credit card companies to bump your credit limits. If you’ve held the cards long enough and timely paid the bills, the issuer might grant your request.

Also, think twice before closing an old credit card, even if you don’t plan to use it. How long you’ve held on to a credit card impacts your credit score; the longer, the better. However, if the card costs an annual fee, you may opt-out of it.

3. Monitor Your Reported History

Careful: all your hard work of maintaining good credit will go to waste if there’s an error that has gone unchecked, which is why Periodically reviewing your credit report helps to correct inconsistencies, errors, and prevents identity theft.

People with good credit scores check their credit report at least once a year. It costs next to nothing as you’re entitled by law to at least one free credit report per year from each of three credit bureaus — Equifax, Experian, and TransUnion.

Check every part of the report, even down to prior addresses. If you find a transaction you never made, chalk that up as a sign of fraud. If you spot a problem, you have the legal right to dispute the information directly with the party furnishing the data.

Beyond that, track your credit score periodically, which is not included in the credit report. Regularly checking the credit score helps you assess the impact of your financial actions on your score. It also enables you to detect problems and rectify them early.

4. Cut down on new credit applications

When you walk into a financial institution and fill out that form to apply for new credit, your lender runs a request to check your credit card. This action shows up on your credit report as an inquiry.

Filling out several loan applications in tandem signals a red flag to your lenders; your credit score will noticeably dip.

Experts suggest that you wait at least six months before you apply for new credit unless you are shopping for a student loan, auto loan, or mortgage, in which case FICO ignores all inquiries made by lenders for the past 30 days.

Attaining a credit score equal or above 800 is challenging, but not impossible. Practice the tips discussed, and you will get a step closer to nabbing that perfect credit score!